9 min read

Buyer intent data: a guide to finding the right data

If you’re reading this, you know the power of buyer intent. Odds are you’re thirsty for more of it.

Buyer intent—aka the signals that indicate how likely someone is to do business with you—is the difference between wasting your time on tire kickers and sealing the deal with eager prospects.

You may think you’ve cracked the code (that’s what your ABM technology vendor promised, right?). But if you’re blind to your dark funnel, you’re blind to a big part of buyer intent.

Now for the good news: We’re here to show you what you’ve been missing.

Keep reading to learn:

- What you need to know about buyer intent

- Why you should focus on finding the right intent data

- How to fill in the gaps in your buyer intent data strategy

The ins and outs of buyer intent

When we talk about buyer intent in a marketing or sales context, we’re talking about how likely a lead is to become a paying customer.

Say there are two potential customers in front of you. One shows buyer intent by actively researching products similar to the ones you sell and asking their peers for recommendations online. The other doesn’t.

If you’re a sales representative with limited time and a quota to hit (so, every sales rep ever), choosing between the two is a no-brainer. You want to focus on leads who are ready to buy. Buyer intent helps you separate those leads from the rest.

Sometimes buyer intent is unmistakable. If a prospect fills out a contact form, requests a demo, or signs up for a free trial, they’re making their intentions clear. But most customers don’t immediately raise their hands like this (if they did, go-to-market teams would be out of a job).

Instead, they send out stealthier signals, such as checking out reviews on G2, performing Google searches for competitive alternatives, or visiting the pricing page on your website.

Companies use these signals to create intent-based marketing campaigns and prioritize sales outreach. The goal is target high-intent buyers and personalize the buying experience to increase sales efficiency.

But you can’t hit your goals without the right intent data.

What is buyer intent data?

Buyer intent data is the information—usually based on digital behavior—that implies buyer intent. For example, when a customer visits your pricing page.

These signals tell you what someone has done, where they did it, and (presumably) what they’ll do next.

There’s no intent-based marketing without intent data—it’s the intelligence that informs audience targeting, channel allocation, and sales messaging.

The problem is, most intent data is weak (insert “Glengarry Glen Ross” monologue here). Traditional intent signals spotlight high-level buying behaviors, but not the people behind them.

What actually works is actionable intent data that shows you how to take action based on buyer signals: what to respond to, who to reach out to, and which channels to reach out on.

And that data is buried in your dark funnel.

Shining a light on the dark funnel

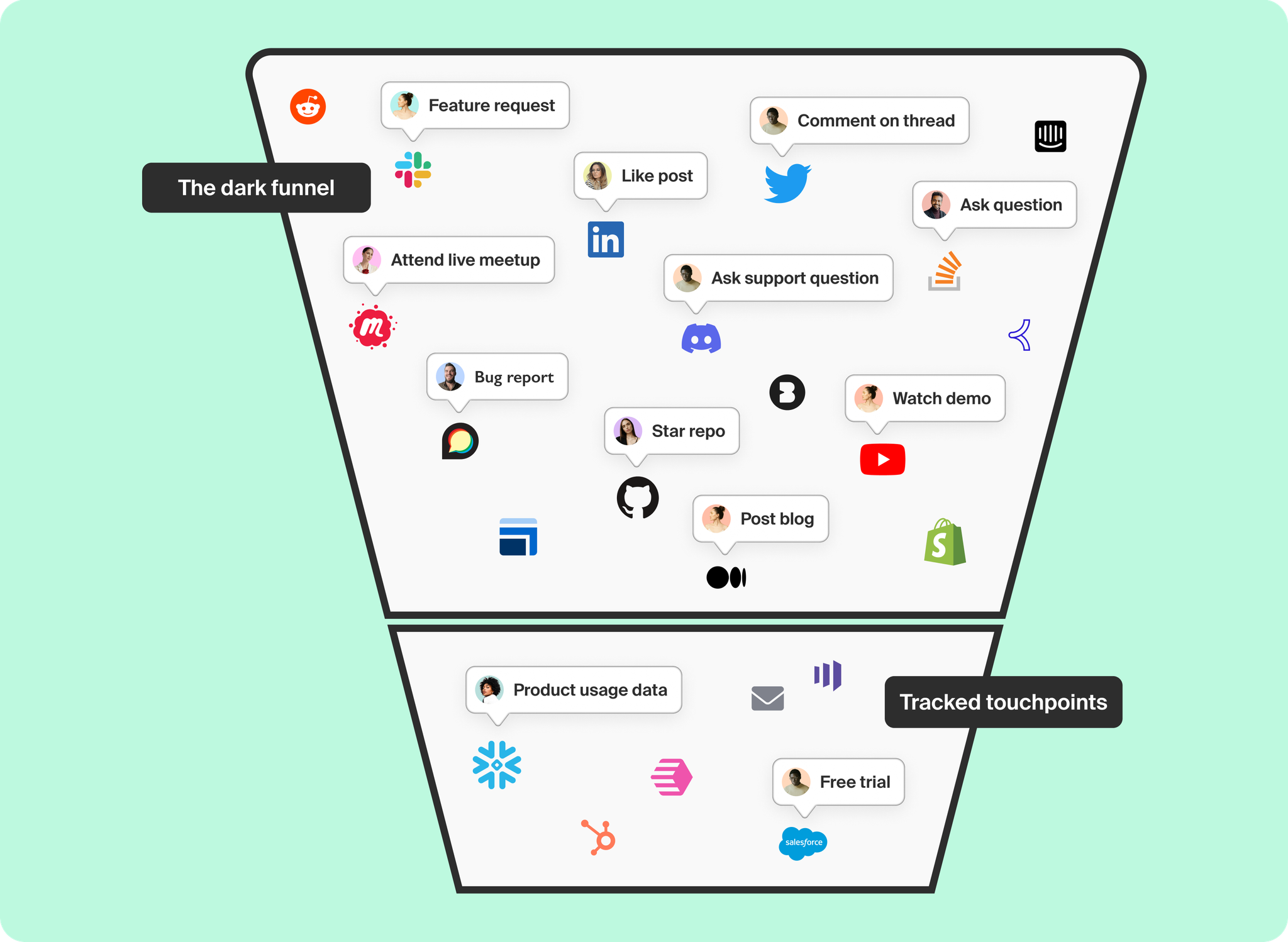

GTM teams only have visibility into a small portion of the customer journey—the rest of it is hidden from view (it’s called the “dark funnel” for a reason).

Sure, you can track buyer activity on owned properties—traffic on your website, comments on your social media posts, feature usage within your product—but that’s a tiny piece of real estate in the online landscape.

Today’s buyers crisscross a wide range of digital watering holes, and these communities are where they ask product questions, share pain points, talk about business goals, and compare solutions.

Translation: Buyers generate a mountain of dark-funnel data you can’t see.

Imagine a buyer who fits your ideal customer profile is on the hunt for a product similar to yours.

They don’t want to get spammed by your sales team, so they steer clear of your website and put out the call on LinkedIn to see if their industry peers have any experience with your product (as well as your competitors’). Then they do the same thing on Twitter.

Next they find some threads on Stack Overflow and Reddit where people have mentioned your product. They start asking the original posters for their opinions.

After that, they take a trip to GitHub to see what your user community is saying. Then they check out some demo videos on YouTube. Then they leave a comment on a Medium article.

They’re still not quite ready to fill out a form, so they decide to join some company-run Slack, Discord, and Discourse communities to get a feel for each vendor.

This person is primed to buy, but unless you have an army of digital sentries at your disposal (just try to get headcount for that), you’re in the dark.

Even if you could track all activity across each and every channel, you’d have no way to connect the dots between them and determine that it’s all coming from the same person.

That’s because current solutions aren’t designed for the modern customer journey.

The struggle to collect useful intent data is real

There’s no shortage of technologies that promise to reveal buyer intent. The problem is they all follow the same outdated playbook.

It goes something like this: An intent vendor crawls or partners with various third-party data sources. It discovers that someone at a target account read an article relevant to your product or industry. It pings you, wags its tail, and waits for you to pat it on the head and say “good boy.”

Fair enough. But what good does that do marketing and sales teams? You still don’t know who the person is (interns read, too!) or whether they’re actually interested in doing business with you.

Account-based marketing and intent providers give you weak (and frequently stale) signals—and only at the account level. Good luck finding the person behind the intent at an account with more than 1,000 people.

But tracking activity at the user level is even worse. How are you supposed to identify and measure which comments on your latest LinkedIn post belong to people in your ICP? Just because someone starred your GitHub repo doesn’t mean they’re a good fit for your product.

Collecting intent data either means settling for cloudy “insights” or tackling the tedious, time-consuming work of sifting through digital signals (but only the signals you have direct access to).

Why finding the right buyer intent data matters

As you can see, not all intent data is created equal.

If you’re blind to buyer identity and the full view of the customer journey, outreach is still just a shot in the dark.

The right buyer intent data helps you:

- Uncover meaningful purchase intent across channels and in real time.

- See the real people behind the buying behaviors.

- Prioritize leads based on fit as well as intent.

- Personalize outreach with full context into the customer journey.

Marketing and sales teams can spend hours researching who a prospect is, whether they’re a good fit, and which channel makes the most sense to reach out on only to discover it’s a massive waste of time—or they can fuel high-quality pipeline faster, easier, and with much less hair pulling.

Using purpose-built tools to find buyer intent data

To uncover and make the most of buyer intent, you need tools that help you detect, centralize, and organize intent data.

Take open-source software company (and Common Room customer) Temporal.

The company tracks activity across Slack, LinkedIn, Twitter, Discourse, YouTube, and other channels to uncover relevant dark-funnel data and bring it together in one place.

🎤 “That's the first place I check every single day and it's much easier to reach out to prospects very quickly. Using Common Room, I know immediately when someone posts a comment on LinkedIn or a question on a community forum.”

—Gozie Nwachukwu, Head of Sales Development at Temporal

Temporal’s sales team can then filter this data to find high-intent and high-fit buyers, add them to dedicated segments, and automate outreach.

🎤 “You always want to find the leads that you know are really likely to convert, and with Common Room, I can see that literally every day.”

—Gozie Nwachukwu, Head of Sales Development at Temporal

The Temporal sales team not only knows who to reach out to, but also where. This helps sellers meet buyers where they are.

🎤 “There are a ton of different data enrichment tools. So for a prospect, you can get their LinkedIn, their email, all different types of profiles. With Common Room, you actually figure out where they're being active. You know if they're using Slack or if they're using LinkedIn or if they're using a community forum, and with that, you can make your outreach a lot more personalized.”

—Gozie Nwachukwu, Head of Sales Development at Temporal

The result isn’t just more meetings, but also better meetings.

🎤 “Over 50% of my meetings come from Common Room. And these tend to be high-quality calls.”

—Gozie Nwachukwu, Head of Sales Development at Temporal

How Common Room helps you synthesize buyer intent in one tool

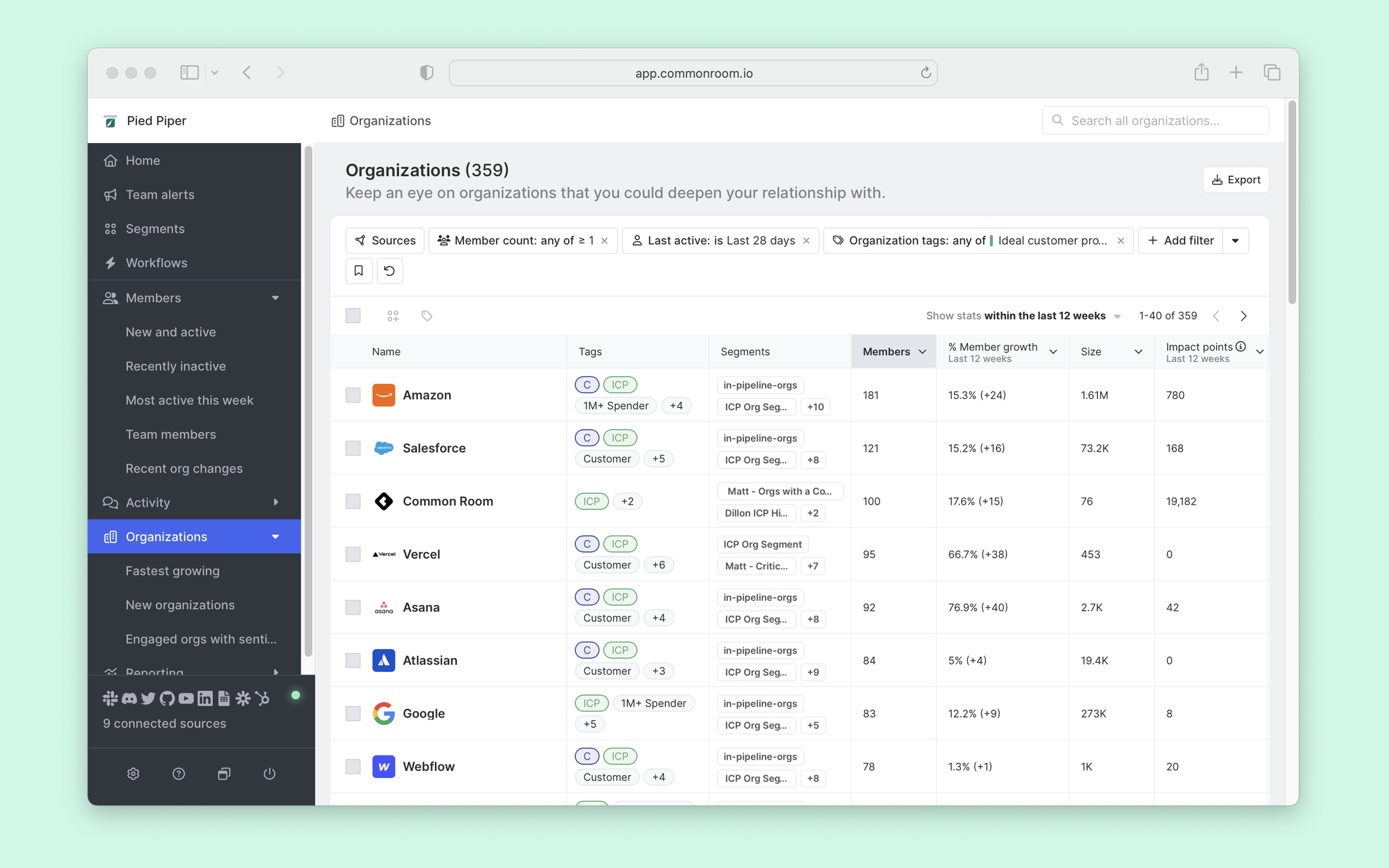

Common Room brings together all your digital interaction, product, and customer data so you can take action on buyer intent with full context.

With dozens of natively built and fully managed integrations with dark-funnel channels (not to mention an API that allows you to add activity from other sources), you get visibility into all traceable digital interaction data.

Common Room’s data enrichment resolves customer identities and creates detailed profiles for every individual (including contact information). By integrating Common Room with your CRM and product data, you can enrich profiles even further (as well as send community-qualified leads directly to your CRM).

Filters in Common Room not only help you spotlight high-intent leads based on their behaviors, they also help you make sure they're high-fit, too. You can filter individuals based on industry, company size, annual revenue, and much more.

Once you’ve zeroed in on the best opportunities, you can add them to customizable segments that allow you to track, report on, and take action on groups of leads at scale.

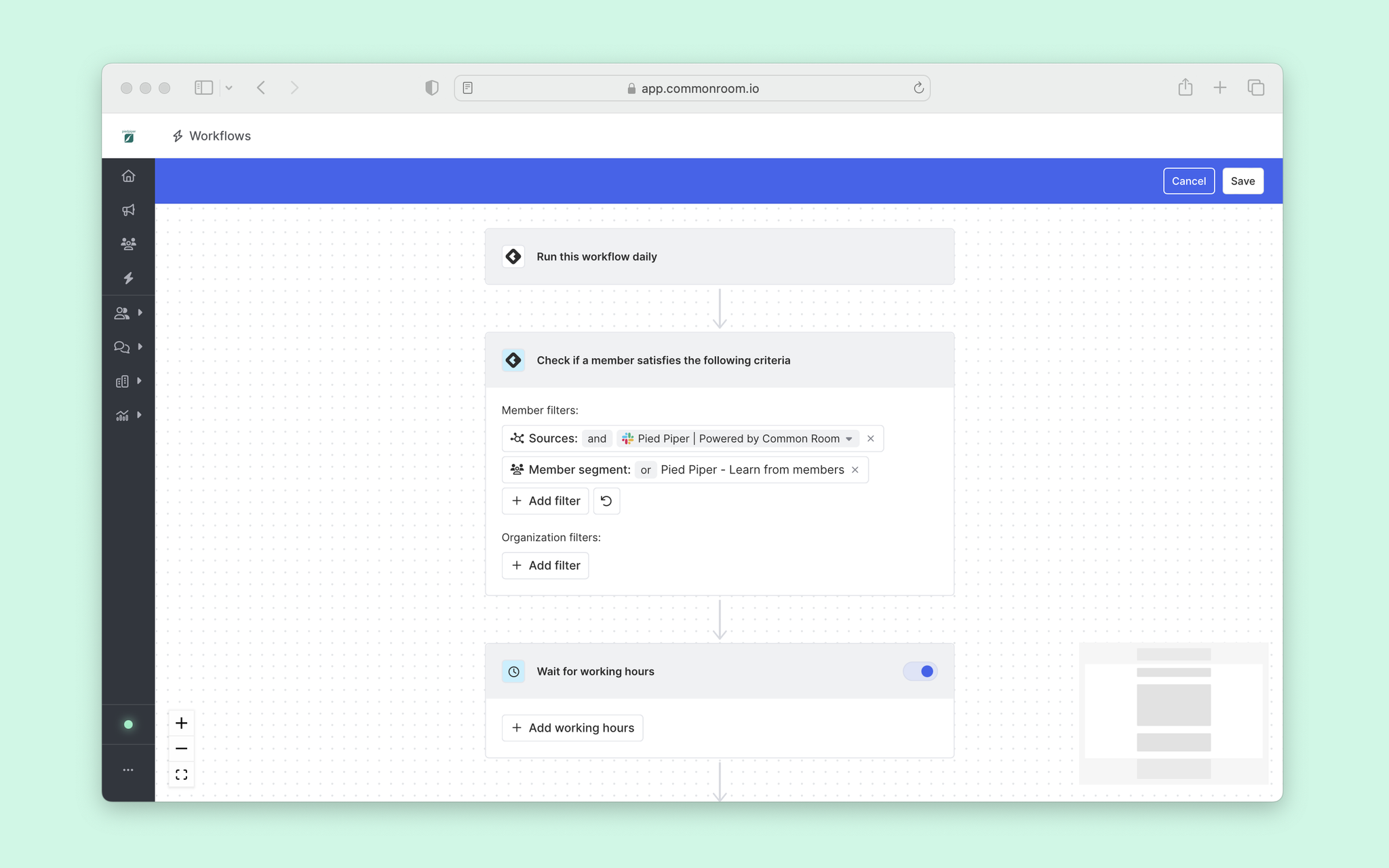

You can even use automated workflows to quickly tag and add leads to a segment and send out messages on different channels (or create team alerts to automatically be notified of any activity among high-intent buyers).

GTM teams work under a ticking clock. Buyer intent allows them to prioritize the leads that are more likely to close—and close faster.

Common Room helps companies close deals 20% faster by uncovering real intent and the real people behind it.

Find real buyer intent with Common Room

Ready to see how Common Room helps you tap into real buyer intent and context?

We think you'd like these

- Sales velocity strategies: 3 that work and 3 that don't

Aug 8th, 2023·7min readDive deep into sales velocity strategies and separate what works from what doesn't.

Aug 8th, 2023·7min readDive deep into sales velocity strategies and separate what works from what doesn't. - Why Gartner thinks you should take modern buying signals seriously

Jun 5th, 2023·6min readLearn why Gartner thinks you should start paying attention to intent, product, and community data.Community

Jun 5th, 2023·6min readLearn why Gartner thinks you should start paying attention to intent, product, and community data.Community - Better together: announcing the Common Room Action Partners Program

Sep 12th, 2024·8min readSee how Common Room's Action Partners Program can help you take action and automate outreach in the way that best...Product

Sep 12th, 2024·8min readSee how Common Room's Action Partners Program can help you take action and automate outreach in the way that best...Product - Post-mortem: Saad Khan on modern sales, signal stacking, and more

Sep 16th, 2024·4min readLearn more about signal-based sales with Saad Khan, Director of Sales and Business Development at Aligned.

Sep 16th, 2024·4min readLearn more about signal-based sales with Saad Khan, Director of Sales and Business Development at Aligned.